Choosing the right life insurance policy represents one of the most impactful financial decisions you can make. A thoughtfully selected policy not only provides a safety net for your loved ones but also serves as a cornerstone of your broader financial planning strategy. With myriad options—from term and whole life to universal and variable plans—navigating the landscape of insurance policies can feel overwhelming.

This guide will walk you through every critical step in selecting the ideal policy: clarifying your objectives, understanding policy nuances, evaluating providers, and fine-tuning your coverage. By the end, you will possess the knowledge and confidence to make an informed choice that harmonizes with your budget, life stage, and long-term goals.

Understanding the Life Insurance Landscape

Life insurance is, at its essence, a contract: you remit regular premiums, and in return your insurer commits to delivering a death benefit to designated beneficiaries if you pass away while the policy is active. Yet beneath this straightforward premise lie a multitude of policy structures, technical provisions, and strategic considerations. Fully grasping these fundamentals will lay the groundwork for intelligently comparing insurance policies.

The Core Purpose of Life Insurance

When you evaluate the necessity of life insurance, focus on the financial obligations and aspirations your absence would impose on those you care about most. A robust life insurance plan can cover final expenses, settle debts and mortgages, replace lost income, fund educational goals, and preserve family wealth. For individuals with dependent children, the death benefit can ensure uninterrupted funding for tuition and living expenses. For homeowners, it can settle the mortgage, sparing survivors from housing insecurity. Even for single policyholders, coverage can shield co-signers from inheriting outstanding liabilities.

Key Terminology to Master

Before diving into policy types, familiarize yourself with these critical terms:

- Premium: The periodic payment you make to retain policy coverage.

- Death benefit: The lump sum paid to beneficiaries upon your passing.

- Cash value: Available only in permanent policies; represents a savings or investment component that grows over time.

- Policy term: The duration for which a policy provides coverage; applicable to term insurance.

- Underwriting: The insurer’s evaluation of your health, lifestyle, and risk profile to determine premium rates and eligibility.

These concepts will recur throughout your research, so ensure you can define them in your own words.

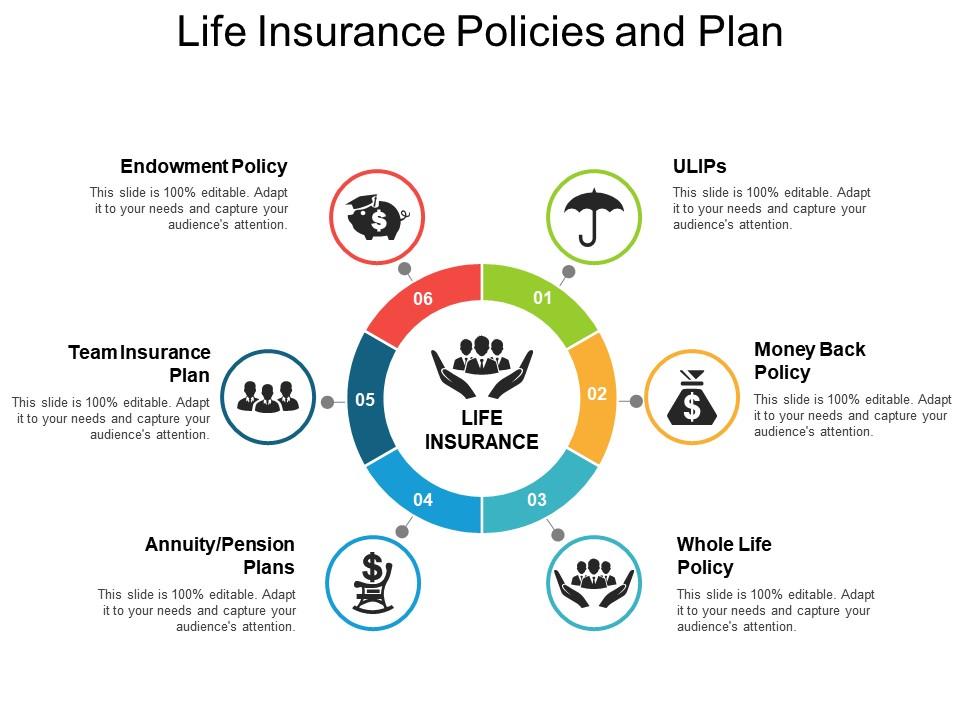

Delineating Policy Types: Matching Structure to Strategy

The single most important decision in the life insurance process is selecting the policy type that best aligns with your financial goals and budget. Below, we explore four main classes of insurance policies, detailing their mechanics, pros and cons, and ideal use cases.

Term Life Insurance

Term life insurance offers coverage for a predetermined period—commonly between 10 and 30 years. It embodies the purest form of risk protection, devoid of any savings component. Because the insurer’s obligation is limited to paying the death benefit within the specified term, premiums are substantially lower than those of permanent policies.

Who Should Consider Term? Individuals seeking maximum protection at minimal cost, particularly young families with mortgage or tuition obligations that will expire once their children reach independence or a mortgage is paid off.

Key Advantages

- Affordability: For a healthy 30-year-old nonsmoker, a 20-year $500,000 policy can cost under $30 per month[^1].

- Simplicity: No cash-value intricacies to monitor.

Potential Drawbacks

- No cash accumulation.

- Coverage lapses at term end, possibly requiring new underwriting at higher rates if extended.

Whole Life Insurance

Whole life insurance is a permanent policy combining a guaranteed death benefit with a cash-value component that accrues at a set rate. Premiums remain level throughout the insured’s lifetime, and the cash value serves as a forced savings vehicle, accessible via policy loans or withdrawals.

Who Should Consider Whole Life? Those who value certainty and discipline in savings, or individuals pursuing estate-planning objectives like wealth transfer and legacy funding.

Key Advantages

- Lifetime coverage: Death benefit remains in force as long as premiums are paid.

- Guaranteed cash value growth: Accrues tax-deferred, offering a stable baseline return.

Potential Drawbacks

- Cost: Premiums can be up to five times higher than term for identical face amounts.

- Limited flexibility: Often stricter rules govern premium payments and withdrawals.

Universal Life Insurance

Universal life insurance offers permanent coverage with a flexible premium structure and adjustable death benefit. The policy’s cash value grows at a variable interest rate tied to market or insurer-declared rates. You can typically increase or decrease premium payments (within limits) and even raise or lower the death benefit.

Who Should Consider Universal Life? Financially savvy buyers who want flexibility to adapt premiums or benefits in response to life changes or market conditions.

Key Advantages

- Premium flexibility: You can pay more or less in a given year, subject to policy minimums.

- Adjustable death benefit: Provides leeway to align coverage with evolving needs.

Potential Drawbacks

- Complexity: Requires vigilant monitoring to avoid lapses if credited interest falls below expectations.

- Interest-rate risk: Cash-value growth depends on market or declared rates, which may fluctuate.

Variable Life Insurance

Variable life insurance immerses the cash-value component into sub-accounts akin to mutual funds. Policyholders assume market risk in exchange for the potential of higher returns. Premiums and death benefits are generally fixed, but cash-value performance can swing with market conditions.

Who Should Consider Variable Life? High-net-worth individuals comfortable with investment risk and seeking growth potential beyond guaranteed rates.

Key Advantages

- Growth potential: Tied directly to market performance for sub-accounts.

- Tax-deferred gains: Allows investments to compound without annual tax impact.

Potential Drawbacks

- Investment risk: Losses in the sub-accounts reduce both cash value and, in some cases, death benefit.

- Fees: Management expenses and mortality charges can erode returns.

Aligning Coverage with Financial Goals

Having parsed policy mechanics, the next task is to pinpoint exactly how much coverage you need and for how long. Overinsuring wastes premium dollars; underinsuring exposes beneficiaries to financial hardship.

Conducting a Thorough Needs Analysis

A robust needs analysis draws on these inputs:

- Debt Obligations: Sum of mortgage balances, car loans, credit cards, and other liabilities that could transfer to survivors.

- Income Replacement: Number of working years remaining multiplied by annual income, to uphold dependents’ living standards.

- Education Funding: Projected college costs for each child, adjusted for inflation.

- Final Expenses: Funeral and estate settlement costs—often $15,000–$20,000.

- Existing Assets: Savings, investments, retirement accounts, and any existing life insurance that can offset the total coverage requirement.

A spreadsheet model that deducts existing assets from total obligations will yield the precise death benefit you should target.

Selecting the Appropriate Term Length

For term policies, aim for a duration that aligns with your longest-lasting need. If your mortgage matures in 25 years and your youngest child turns 22 in 20 years, a 25- or 30-year term ensures coverage through peak liability years. Many insurers now extend terms up to 40 years for younger applicants, offering greater latitude.

Vetting Insurance Providers: Beyond the Price Tag

Once you determine your target death benefit and preferred policy type, the focus shifts to choosing a reputable insurer. Two metrics stand out: financial strength and customer experience.

Financial Strength Ratings

An insurer’s ability to satisfy claims decades into the future hinges on robust capital reserves and prudent risk management. Consult ratings from leading agencies:

- A.M. Best

- Moody’s

- Standard & Poor’s

Aim for carriers rated “A” (Excellent) or above (e.g., A+, AA). A downgrade in ratings can foreshadow financial distress, risking delayed or reduced payouts.

Customer Service and Claims Reputation

Policy servicing and claim processing speed directly impact your beneficiaries’ experience. Survey the National Association of Insurance Commissioners (NAIC) complaint index to compare carriers’ track records. Additionally, peruse third-party review platforms to gauge real-world satisfaction with underwriting transparency, billing accuracy, and claim settlements.

Policy Riders: Personalizing Your Plan

Riders allow you to tailor a base policy to your unique circumstances. Frequently recommended riders include:

- Accelerated Death Benefit: Access a portion of the death benefit upon a terminal diagnosis, alleviating medical costs.

- Waiver of Premium: Senior in disability scenarios, waives future premiums if you suffer a qualifying disability.

- Guaranteed Insurability Option: Permits the purchase of additional coverage at set intervals—ideal for expanding families or career advancements.

While riders enhance flexibility, each comes with incremental costs. Assess whether the added premium justifies the potential benefit.

Smart Shopping Techniques to Maximize Value

Obtaining the best combination of price and policy quality requires systematic shopping. Employ these strategies:

Online Quote Aggregators

Platforms such as Policygenius and SelectQuote enable rapid aggregation of multiple carriers’ quotes. By inputting standardized information, you can compare premiums and features side by side without filling out separate applications.

Independent Agents vs. Direct Writers

Independent agents represent multiple insurers, offering access to competitive quotes and personalized guidance. Direct writers, by contrast, offer only their in-house products, which may result in lower overhead but restrict choice. If you value impartial advice and broad market access, an independent agent is often preferable.

Discounts and Bundling Opportunities

- Non-Smoker Discounts: Many carriers offer substantial rate reductions for applicants who have quit tobacco.

- Multi-Policy Discounts: Bundling auto, homeowners, and life insurance with a single carrier can yield premium savings of 5–15%.

- Electronic Underwriting: Carriers increasingly provide no-exam or limited-exam underwriting for applicants meeting strict health criteria, resulting in expedited approvals and potential rate advantages.

Navigating the Application and Underwriting Maze

Understanding the underwriting process helps you anticipate documentary requirements and potential rate impacts.

Medical Exam Protocols

Traditional underwriting mandates a paramedical exam, lab tests, and a detailed health questionnaire. Insurers assess your risk based on factors such as blood pressure, cholesterol levels, and family medical history. If you prefer to avoid needles, inquire about accelerated underwriting programs that evaluate your fitness via digital health databases, motor-vehicle records, and pharmacy histories.

Accurate Disclosure Is Non-Negotiable

Full transparency about tobacco use, hazardous hobbies, international travel, and pre-existing conditions is vital. Even minor discrepancies discovered during claims processing can trigger policy rescission or benefit delays. Always double-check your application before signing.

Ongoing Review and Policy Maintenance

Selecting a policy is not a one-and-done event. As life evolves, your coverage should adapt accordingly.

Triggering Events for Policy Updates

- Marriage or Divorce: New dependents or changing obligations necessitate coverage adjustments.

- Birth or Adoption: Expanding your family creates fresh financial responsibilities.

- Mortgage Pay-off: Once your home loan is retired, consider reducing coverage or reallocating resources.

- Income Fluctuations: Significant raises or career shifts may call for higher coverage to preserve lifestyle continuity.

- Health Changes: Improved health through lifestyle modifications could qualify you for better rates upon policy review or conversion.

Converting Term to Permanent Coverage

Many term policies include conversion options allowing you to transition to a permanent plan without additional medical screening. Exercising this option early can lock in coverage despite future health deterioration, albeit often at higher premium rates than new-issue permanent policies for comparable ages.

Integrating Life Insurance into Holistic Financial Planning

Life insurance should not operate in a vacuum. Consider how your policy fits within your broader financial architecture.

Coordination with Retirement Planning

The cash-value component of permanent life insurance can function as an alternate savings vehicle, offering tax-deferred growth and potential policy loans. However, it should complement—not replace—retirement accounts such as 401(k)s and IRAs that benefit from higher contribution limits and tax advantages.

Estate and Legacy Strategies

For high-net-worth individuals, permanent life insurance policies can facilitate estate-tax mitigation. Irrevocable life insurance trusts (ILITs) remove policy proceeds from your taxable estate, ensuring heirs receive the full death benefit tax-free.

Business Owner Considerations

Entrepreneurs can leverage life insurance for business-continuation plans. Key-person insurance, buy-sell agreements funded by life policies, and debt-cover strategies protect both the company and surviving partners from financial disruption.

Common Pitfalls and How to Avoid Them

Even well-meaning buyers can stumble into costly mistakes. Be wary of these traps:

- Chasing Lowest Rates Alone: Ultra-low premiums may mask restrictive terms, surrender charges, or aggressive underwriting that penalizes future changes.

- Overlooking Policy Fees: Variable and universal policies often carry hidden fees—administrative charges, mortality and expense fees, and fund management fees.

- Neglecting Conversion Deadlines: Many term policies impose a conversion window. Missing this cutoff can forfeit your opportunity to switch to permanent coverage without new underwriting.

Combat these pitfalls by reading policy illustrations carefully, asking pointed questions, and enlisting a fiduciary or independent advisor when uncertainty arises.

Final Thoughts

Securing the right life insurance policy demands a disciplined, research-driven approach. Begin by defining your coverage objectives, proceed to understand the distinctive features of term and permanent policies, and then narrow your focus to carriers with robust financial ratings and stellar service. Supplement your base policy with riders that reflect your unique circumstances, and leverage online tools and independent agents to extract the best market value. Finally, institute periodic policy reviews to align coverage with changing life events.

By adhering to this roadmap, you can confidently select an insurance plan that balances cost, flexibility, and long-term security—providing peace of mind for you and a lasting legacy for your loved ones.