Investing time to find a checking account that rewards you rather than drains your funds is one of the simplest yet most impactful financial decisions you can make. Financial institutions continually compete to attract new customers by offering lucrative incentives, such as cash bonuses, high interest yields, and fee waivers. If you’re not paying attention, you could be leaving hundreds—if not thousands—of dollars on the table. In this comprehensive guide, you’ll discover how to identify the best new checking account offers, evaluate their benefits, and strategically optimize your banking behavior to make the most of every dollar.

Introduction: The Unseen Opportunity in Everyday Banking

Checking accounts sometimes get a bad rap as mere transactional tools with little to no benefits attached. However, in recent years, banks and credit unions have ramped up their promotional efforts, unveiling offers designed to reward new customers handsomely. These promotions can range from simple cash bonuses for meeting minimum deposit thresholds to tiered rewards programs that pay interest rates rivaling those of high-yield savings accounts.

By exploring these new checking account deals and understanding how they function, you’re effectively turning a routine bank account into a mini investment vehicle—a way to earn money without significantly altering your financial habits. Navigating this landscape requires more than just picking the first promotion you see. You need to consider eligibility requirements, account fees, transaction thresholds, and potential pitfalls.

In the sections that follow, we’ll walk through the key factors that differentiate checking account offers, provide strategies for meeting requirements without incurring extra costs, and share insider tips for integrating new accounts into your broader financial plan. Whether you’re a college student looking for fee-free banking, a busy professional seeking high-yield returns on idle cash, or someone simply curious about how to leverage everyday banking to boost your bottom line, this guide will equip you with the knowledge and tools you need.

Why Checking Account Promotions Matter More Than You Think

It’s easy to underestimate the value of a checking account beyond its transactional functionality. After all, if you don’t anticipate carrying substantial balances or paying high fees, why bother shopping around? The reality is that banks are willing to invest significant marketing dollars to acquire customers because, over time, a relationship with you can yield far greater returns than the initial promotional cost.

Banks’ Hidden Profits on Checking Accounts

Banks make money on checking accounts through various channels. They charge overdraft fees, foreign transaction fees, and ATM fees, and many accounts have maintenance charges unless certain criteria are met. More subtly, banks profit from the float—the brief period between when you deposit a check and when it clears—using that money to invest in higher-yield assets. Moreover, payment networks pay banks transaction fees each time you swipe your debit card. As these revenue streams accumulate, the average bank can recoup more than the value of any sign-up bonus within months.

Why Banks Offer Generous Sign-Up Bonuses

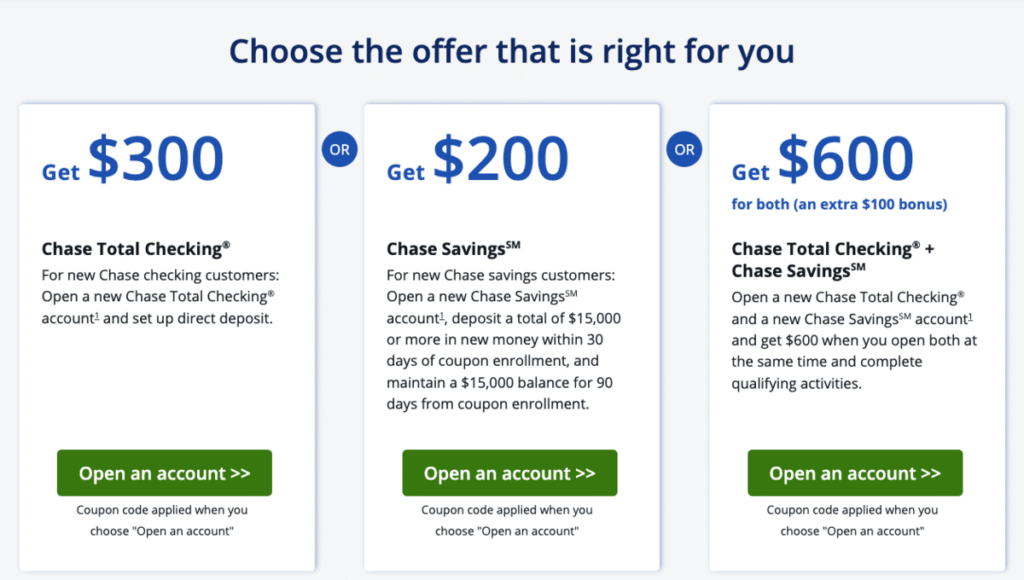

Promotional incentives are not altruistic gestures. Banks view new customers as potential long-term assets who will eventually generate revenue through additional products—like credit cards, auto loans, mortgages, and wealth management services. A checking account with direct deposit, for instance, often serves as a gateway to auto payments and loan repayments, solidifying their relationship with you. By offering a $200–$500 cash bonus for opening an account and meeting deposit requirements, banks are effectively betting on your future profitability.

Consumers’ Mindsets Need to Shift

If you’ve ever thought of checking accounts as a commodity, it’s time to rethink. The fine print and eligibility criteria attached to these offers often mask substantial value. By adopting a proactive mindset—constantly on the lookout for top promotions and willing to meet basic requirements like direct deposit or minimum balance thresholds—you can effectively “earn” a risk-free return simply by redirecting your finances.

Throughout this guide, we’ll examine various types of promotions, clarify the common terms banks use, and reveal the clever tactics that can transform everyday checking account maintenance into a lucrative side hustle.

Understanding the Anatomy of Checking Account Offers

Checking account offers can vary widely in structure and value. To make an informed decision, it’s crucial to break down each promotion into its constituent components. In this section, we’ll demystify the common elements you’ll encounter: sign-up bonuses, interest rates, fee waivers, and rewards programs.

Sign-Up Bonuses: Beyond the Headline Numbers

Sign-up bonuses are the most headline-grabbing aspect of many checking account promotions. You’ll often see ads proclaiming “Earn $300 when you open a new account and set up direct deposit,” or “Get $250 after depositing $5,000 within 30 days.” However, these figures don’t tell the whole story.

Key Terms and Thresholds

Most sign-up bonuses hinge on specific actions within a defined time frame. Common requirements include:

- Minimum Deposit Amount: You might need to deposit $1,000–$5,000 within a certain number of days after account opening.

- Direct Deposit Enrollment: Banks often require a recurring direct deposit—such as a paycheck or government benefit—to qualify.

- Debit Card Transactions: Some offers entail a minimum number of debit card purchases in the first 30–90 days.

- Account Funding Timeline: Always check whether the deposit must come from an external account (payroll, another bank) or if transfers between accounts within the same institution qualify.

Timing Is Everything

It’s essential to understand when the bank counts a deposit toward your bonus. For instance, if you set up direct deposit on Day 1, but the first paycheck arrives on Day 40, you might miss the window for the bonus. Because every bank sets its own timeline—30 days, 60 days, or even 90 days—read the fine print carefully.

Evaluating Net Gain

A $300 bonus might sound appealing, but if you’re required to maintain a $10,000 balance for 90 days in an account that yields only 0.01% APY, your opportunity cost could outstrip the bonus’s value. Conversely, if you already have a paycheck that arrives each month via direct deposit, that requirement might be negligible. Always calculate the practical cost of meeting the bonus criteria—considering potential interest earnings or forfeited returns elsewhere—to determine its true profitability.

Interest Rates: When Checking Accounts Behave Like Savings Vehicles

Some checking accounts advertise competitive interest rates—sometimes upwards of 1.00% APY, especially in promotional periods. While high-yield checking accounts rarely match the rates found in online savings or money market accounts, the convenience and liquidity they offer can make them attractive for holding emergency funds or short-term savings.

Tiered Interest Structures

Many high-yield checking accounts employ a tiered interest rate system. For instance, you might earn 1.20% APY on balances up to $15,000, but anything above that reverts to a nominal rate of 0.05% APY. These tiers often come with strings attached, such as requiring a minimum number of debit card transactions or direct deposit each month to qualify for the top-tier rate.

Balancing Requirements vs. Returns

If you’re the type of consumer who can comfortably meet the monthly transaction or deposit requirements, the extra yield can be worth pursuing. However, if you’re a light user of your debit card—maybe you prefer credit cards or cashback-focused cards—the time and effort to hit those transaction thresholds could offset the benefits. Always ask yourself: are you likely to naturally meet the requirements? If so, the interest bonus is essentially free money. If not, you may want to consider a plain-vanilla high-yield savings account instead.

Fee Waivers: Eliminating Hidden Costs

Routine banking fees—monthly maintenance fees, overdraft fees, ATM fees, foreign transaction fees—can silently erode your balance over time. Many promotional checking accounts offer fee waivers as part of the package, effectively lowering your cost of banking.

Waived Monthly Maintenance Fees

A common requirement for fee waivers is to maintain a minimum daily balance—often in the range of $1,500 to $3,000—or to have a specified monthly direct deposit. If you can meet these criteria without significant effort, you avoid the typical $10–$15 monthly fee that afflicts many standard accounts. Over the course of a year, that waiver alone could represent $120–$180 in savings.

Cheap or Free ATM Access

Some bank promotions reimburse ATM fees—both in-network and out-of-network—up to a specified monthly cap, such as $15 or $25. If you frequently withdraw cash from non-affiliated ATMs, this benefit can quickly offset the cost of using your account. However, if you rarely use ATMs and rely primarily on digital payments, this perk may hold less appeal.

Overdraft Protection and Courtesy Pay

In certain checking accounts, you’ll find overdraft protection programs that prevent your account from incurring steep overdraft fees (which can exceed $35 per incident). Instead, the bank might transfer funds from a linked savings account or line of credit for a smaller transfer fee—perhaps $10. If you’re prone to occasional miscalculations or delayed deposits, this form of protection can be a financial lifesaver.

Foreign Transaction Fee Rebates

Frequent travelers should scan for accounts that waive foreign transaction fees on debit card purchases. If you spend $2,000 per year abroad, a 3% foreign transaction fee would cost you $60. Some accounts that eliminate this charge can effectively reimburse you for those extra costs.

Rewards Programs: Cashback, Points, and Perks

Credit cards often get the glory for reward points, but checking accounts are increasingly adopting their own incentive structures. These can include cashback on certain categories (e.g., grocery stores, wellness services) or “points” convertible into merchandise, travel, and gift cards.

Cashback Checking Accounts

A subset of rewards checking accounts pay you back for card purchases. For example, you might earn 1% cashback on up to $1,000 in debit card transactions each month—essentially $10 per month or $120 annually if you max out the limit. Typically, these accounts require fulfilling tiered requirements (e.g., 15 debit card transactions per month, one direct deposit) to trigger the cashback mechanism. Break too many of these requirements, and you wind up with a nominal 0.01% APY checking account.

Points-Based Systems

Other accounts accumulate points per dollar spent—perhaps 1 point for every $2 of debit card purchases—and these points can be redeemed through the bank’s portal. The redemption value can fluctuate: 1,000 points might be worth $10 in general merchandise, or less if redeeming for statement credits. Always investigate the cost per point, the flexibility of redemption options, and whether points expire. For consumers who enjoy browsing catalogs or have existing loyalty programs with the bank, these systems can yield substantial value.

Bonus Perks: No-Fee Events and Exclusive Offers

Beyond direct monetary rewards, some banks offer perks such as waived safety deposit box rentals, free identity protection services, or discounted tickets to events. While these extras might be niche, they can add up if they align with your lifestyle. For instance, if a bank gives you two free tickets to a local sporting event or a discounted annual subscription to a financial planning app, that’s incremental value you might not have otherwise received.

Identifying Your Personal Banking Goals

Before picking the first big bonus you see, take a moment to outline your financial objectives. What do you value most in a checking account? Is it a one-time cash infusion to pad your emergency fund? Elevated interest rates on idle cash? A frictionless fee structure? Or perhaps a suite of rewards aligned with your spending patterns?

Short-Term vs. Long-Term Value

Short-Term Gain: Maximizing the Sign-Up Bonus

If cash flow is tight or you’re funneling money into higher-return investments, a sign-up bonus can serve as an immediate financial cushion. For example, a $300 bonus can cover a month’s groceries or serve as a launchpad for a Roth IRA contribution. If you have the liquidity to satisfy the minimum deposit or spending requirements without sacrificing your broader financial stability, pursuing that bonus now is a rational move.

Long-Term Value: Sustained Perks and Competitive Rates

Perhaps you’re planning to keep your checking account open indefinitely. In that case, ongoing benefits—like competitive APY on balances, no monthly fees, ATM network partnerships, and rewards on debit transactions—become more consequential. Even if the initial bonus pales in comparison to that offered by a competing bank, the cumulative long-term value could outweigh the immediate payout. Consider that a 0.50% APY on a $10,000 checking balance amounts to $50 per year in interest alone. If you also earn $120 per year in cashback rewards, you’re looking at $170 annually—more than a one-time $200 bonus if you’re in the account for several years.

Alignment with Your Banking Habits

It’s not enough for an offer to look shiny on paper; it must integrate smoothly with your existing financial ecosystem. Ask yourself:

- How Frequently Do You Use Your Debit Card? If you rarely use debit cards, chasing a rewards-based checking account that requires 15–20 debit transactions per month will likely result in unmet requirements. Conversely, heavy debit card users might find these accounts extremely rewarding.

- What Is Your Typical Account Balance? If your balances frequently dip below required minimums—perhaps because you route money into investments or savings—then opting for a premium account that penalizes low balances may cost you more than it earns you.

- Do You Have Regular Direct Deposits? If you’re self-employed or paid by check, enrolling in direct deposit might be inconvenient. Some banks allow mobile check deposits to satisfy this requirement, but you need to verify that the bank acknowledges that as qualification.

- Will You Need Frequent ATM Access? If you live in a rural area or travel often, ensuring your bank has a robust ATM network (or reimburses out-of-network fees) can save you tens of dollars per year.

- How Comfortable Are You with Multiple Accounts? Juggling several accounts—opening one for a bonus, another for high-yield interest, and a third for fee-free ATM access—can become administratively burdensome. If you’re willing to manage multiple accounts and calendar reminders for requirement deadlines, you can potentially stack bonuses and benefits. If not, a single account with balanced perks might be more pragmatic.

Top Checking Account Offers: A Sample Review

The checking account landscape evolves rapidly. Promotions that begin in January can disappear by March as banks reassess their customer-acquisition strategies. Below, we highlight a snapshot of some of the most competitive offers available as of June 2025. Note that specific terms—minimum deposit amounts, spending thresholds, and bonus timing—can and do change frequently. Always verify current details directly on the bank’s website before applying.

Source: Bankrate “Best Checking Accounts of 2025” (https://www.bankrate.com/banking/checking/best-checking-accounts/)

1. Coastal Financial Bank: $400 Cash Bonus + 1.00% APY on Balances Up to $10,000

- Bonus Requirement: Open a new interest-bearing checking account, deposit $2,000 within 30 days of account opening, and enroll in recurring direct deposit of at least $500 in the first 60 days.

- Promotion Period: Valid for new checking customers who open an account by July 31, 2025.

- Ongoing Benefits:

- Tiered APY of 1.00% on balances up to $10,000 if you maintain at least 10 debit card transactions per month and one direct deposit; 0.05% APY on any excess balance above $10,000 or if requirements not met.

- No monthly maintenance fee if direct deposit criteria met or if daily balance stays above $2,500. Otherwise, $12 monthly fee.

- Up to $15 in ATM fee reimbursements per statement cycle for out-of-network ATM withdrawals.

- Free overdraft protection transfers from a linked savings account (transfer fee: $10).

This Coastal Financial offer balances a healthy sign-up bonus with a competitive ongoing yield—provided you naturally meet the debit card transaction requirements. If you receive biweekly paychecks, you can satisfy the direct deposit requirement easily; just ensure $500 per deposit flows through. For $2,000 and ten monthly debit card purchases, you unlock 1.00% APY on up to $10,000, which equates to $100 per year in interest alone—on top of your $400 bonus.

2. Apex National Credit Union: $300 Bonus + No-Fee Checking

- Bonus Requirement: Deposit a cumulative $1,500 within 45 days of account opening and set up qualifying direct deposit of $500 or more per month for at least two consecutive months.

- Promotion Period: Enrollment by August 15, 2025, for eligible applicants (must be within Apex’s membership area or join via an affiliated partner).

- Ongoing Benefits:

- No monthly maintenance fee for life as long as you maintain either a $500 average daily balance or one direct deposit per month. Otherwise, a $5 monthly fee applies.

- Unlimited ATM fee reimbursement at participating ATMs nationwide.

- Up to $50 per quarter covered in overdraft fees provided you enroll in overdraft protection (linked to savings or line of credit).

- Automatic enrollment in a points-based rewards program: earn 2 points per $5 debit transaction; redeem points for statement credits, travel, gift cards, or financial wellness services.

Apex National’s lower minimum deposit makes the $300 bonus highly accessible. If you regularly use your debit card for everyday purchases—grocery runs, gas, bills—you’ll naturally rack up points. Though the APY is nominal (0.05%), the unlimited ATM fee reimbursements and waived monthly fees can yield considerable savings, particularly if you rely on multiple networks.

3. Summit Digital Bank: $500 Bonus + 2.00% APY on $25,000 Balances

- Bonus Requirement: New-to-bank customers must deposit a minimum of $5,000 within 15 days of opening a Summit Digital checking account, and maintain that $5,000 balance for 90 days. No direct deposit or debit transaction requirements.

- Promotion Period: Enrollment through September 30, 2025.

- Ongoing Benefits:

- 2.00% APY on balances up to $25,000 if you make at least 15 qualifying debit card purchases per month; 0.10% APY otherwise.

- No monthly maintenance fee regardless of balance or activity.

- Unlimited ATM fee reimbursements worldwide.

- Free Zelle transfers and no foreign transaction fees on debit purchases.

- Complimentary identity theft protection and credit monitoring service.

Summit Digital’s high bonus and elevated APY make it an appealing option for individuals who have substantial cash reserves. By depositing $5,000, you immediately qualify for the $500 bonus. If you consistently spend with the debit card (15 transactions per month), you’ll also earn an impressive 2.00% APY on up to $25,000—$500 per year in interest if you maintain that maximum. Even if you can’t hit 15 transactions, 0.10% APY on $25,000 still yields $25 annually, combined with no fees and global ATM reimbursements.

4. Heritage State Bank: $250 Bonus + Tiered Debit Card Rewards

- Bonus Requirement: Open a new checking account, deposit $1,000 within 60 days, and complete 10 debit card purchases totaling at least $500 in the first 90 days.

- Promotion Period: Must open by June 30, 2025.

- Ongoing Benefits:

- 1.50% APY on balances up to $5,000 if you maintain 12 debit card transactions per billing cycle; otherwise, 0.01% APY on all balances.

- No monthly maintenance fee if at least one direct deposit posts per month or if daily balance exceeds $1,500. Otherwise, a $7 monthly fee.

- Debit card rewards: 1% cashback on all gas, grocery, and pharmacy purchases, up to $300 combined monthly; 0.25% cashback on other eligible purchases.

- Free bill pay, free eStatements, and mobile check deposit.

Heritage State Bank’s offer is tailored to everyday spenders. If you frequently fill up your gas tank or pick up groceries, the tiered APY of 1.50% on the first $5,000 could deliver $75 per year in interest—plus 1% cashback on those categories. The balance requirement of $1,500 for fee waiver is manageable for many families, and a $250 bonus for $1,000 in deposits translates to a 25% return on your funds.

5. MetroLink Bank: $350 Bonus + Student-Friendly Perks

- Bonus Requirement: Available exclusively to students aged 17–24 with valid school ID; deposit $500 and make at least five debit card purchases within 60 days of account opening.

- Promotion Period: Open through August 31, 2025.

- Ongoing Benefits:

- No monthly maintenance fees for student accounts until age 25; thereafter, waived with $500 direct deposit or monthly average balance of $1,000.

- Up to $10 in ATM fee reimbursements per statement cycle.

- Unlimited mobile check deposit and free online banking.

- 1% cashback on all purchases made with the student debit card, up to $500 in purchases monthly.

- Access to financial literacy workshops and free identity theft monitoring.

For college students and young adults, MetroLink’s student account delivers both an immediate bonus and ongoing incentives. The $350 bonus for a $500 deposit is a considerable 70% return. Even if you don’t transact heavily, the absence of monthly fees and the 1% cashback on debit card purchases can accelerate savings. Pairing this account with a high-yield savings account for surplus funds can create a robust, multi-pronged financial approach for students.

How to Select the Right Checking Account Offer for You

With dozens of promotions circulating at any given moment, narrowing down the field can be daunting. Here are the critical steps to ensure you choose the optimal offer based on your individual circumstances.

1. Conduct a Preliminary Needs Assessment

Before diving into granular comparisons, evaluate your banking profile:

- Average Monthly Balance: Identify how much you typically keep in checking.

- Monthly Income Streams: Note whether you receive recurring paychecks, freelance deposits, or gig-economy earnings.

- Debit Card Usage: Track how many debit purchases you make per month and the typical transaction amounts.

- ATM Withdrawal Frequency: Determine if you frequently need cash and whether you can rely on in-network ATMs.

- Fee Sensitivity: Assess whether you’re willing to maintain minimum balances or set up direct deposit to avoid monthly maintenance fees.

Performing this needs assessment clarifies which factors hold the most weight. For instance, if your average balance rarely exceeds $1,000, a tiered APY that only kicks in above $5,000 is irrelevant to you. Conversely, if you routinely spend $2,000 on your debit card each month, a cashback checking account could become a small but reliable revenue stream.

2. Compare Sign-Up Bonus Requirements and Potential Pitfalls

Scan each promotion’s fine print to ensure the bonus requirements align with your habits:

- Funding Sources: Confirm whether internal transfers qualify for the minimum deposit. If you want to move money quickly from an existing account, ensure that counts.

- Direct Deposit Nuances: If your employer processes payroll every other Friday, ensure that timeline matches the bank’s “within 30 days of account opening” requirement.

- Qualifying Transactions: Some banks stipulate minimum purchase amounts per transaction—if your typical coffee runs cost under $5, they might not qualify.

- Exclusions and Ineligibilities: Certain accounts exclude existing customers, those with prior account closures, or individuals younger than 18. Always verify your eligibility before applying.

- Bonus Timing and Crediting: Make sure the bank will credit your account with the bonus promptly—sometimes it takes up to 90 days after meeting all conditions. If you shut down the account too soon, you may forfeit the bonus retroactively.

3. Evaluate Ongoing Account Features Versus Fees

Once the bonus period concludes, you want to make sure the account remains beneficial:

- APY Conditions: Note if the advertised high APY is contingent on maintaining a minimum number of debit transactions, direct deposits, or a specific debit monthly usage. If those conditions are unlikely to be met, factor in the baseline APY.

- Monthly Maintenance Fee Waivers: Identify all ways to waive the fee—maintaining a specific minimum balance, establishing direct deposit, or linking to another account.

- ATM Networks and Fee Reimbursements: Verify the breadth of in-network ATMs and how many out-of-network fee reimbursements the bank provides.

- Overdraft Policies: Look beyond the rhetoric and find out how often the bank charges overdraft fees, what the daily limit is, and whether they offer courtesy pay. Average customers incur multiple overdraft fees per year; having a lower-cost alternative can be a major advantage.

- Additional Perks and Services: Assess whether you’ll use extras like free identity theft protection, mobile deposit, free bill pay, or exclusive discounts on banking products. These services can add up to significant intangible savings if they align with your lifestyle.

4. Factor in the Long-Term Relationship Potential

Opening a new checking account is not just about that one-time bonus; it’s an entry point into a relationship with the institution:

- Cross-Selling Potential: If you believe you’ll eventually need a mortgage, student loan refinance, or small business loan, look for banks with competitive rates on those products. Establishing a relationship through checking can earn you loyalty discounts later.

- Customer Service Reputation: Read user reviews—both on the bank’s website and independent sites like NerdWallet or Consumer Reports. A bank that offers excellent in-person service or a highly rated mobile app can enhance your banking experience far beyond the initial bonus.

- Technological Features: If you rely heavily on mobile banking, check for features like real-time alerts, easy mobile check deposit, advanced budgeting tools, and integrations with third-party financial apps.

- Community and Values Alignment: Some consumers prefer credit unions or smaller regional banks due to their community focus, corporate values, or commitment to sustainability. While these aspects don’t always directly translate into financial benefits, aligning your banking relationship with your principles can add personal satisfaction.

Step-by-Step Guide to Applying and Qualifying for a Checking Account Bonus

Now that you know what to look for, here’s a practical roadmap to ensure you qualify for and receive your bonus without hiccups.

Step 1: Gather Documentation and Pre-Qualify

Before you start the application process, collect the following:

- Government-Issued ID: A valid driver’s license or passport to verify your identity.

- Social Security Number: Required for identity verification and tax reporting.

- Proof of Residence: Some banks may request a recent utility bill or lease agreement showing your address.

- Employment Verification: If the bonus requires direct deposit, have your employer’s routing and account number on hand or know how to set up mobile deposit if that counts.

- Current Banking Information: If you plan to transfer funds from an existing account to meet the minimum deposit, have that routing and account number available.

Many banks allow you to pre-qualify online by verifying whether you meet basic eligibility criteria (e.g., not an existing customer, within the age requirement) without impacting your credit score. Use these pre-qualification tools to avoid unnecessary hard inquiries.

Step 2: Complete the Online Application

When you apply online, follow these best practices:

- Double-Check Your Personal Information: Typos in your name, Social Security number, or address can delay or derail your approval.

- Opt Out of Overdraft Protections if You Prefer: If you want to avoid the temptation—and costs—of overdrafting, choose a checking account with no overdraft features or explicitly decline courtesy pay.

- Ensure You Elect Paperless Statements (If Required): Some offers mandate eStatements to qualify for the bonus. Confirm that you opt in for electronic deliveries.

- Use a Unique Email Address: Sometimes, banks will send bonus-related communications to the email on file. By using a frequently monitored email, you avoid missing crucial notices about fulfilling the offer.

Step 3: Fund the Account and Fulfill Requirements

Once your account is open, act promptly:

- Deposit Funds Within the Designated Window: If you need to deposit $2,000 within 30 days, schedule that transfer immediately.

- Set Up Direct Deposit: Contact your employer’s payroll or benefits department to change your direct deposit routing. If that’s not possible, investigate if a mobile check deposit from your existing account counts.

- Track Your Debit Card Transactions: Use your debit card to make everyday purchases—groceries, gas, utility bills—to meet any transaction requirements. If a bank requires 15 debit transactions, spread them throughout the month to avoid a last-minute scramble.

- Maintain Any Minimum Balances: If you need to keep $5,000 in the account for 90 days, avoid dipping below that threshold. Even a brief balance shortfall can disqualify you from the bonus.

Step 4: Monitor the Bonus Posting and Account Conditions

After you’ve met all conditions:

- Set Calendar Reminders: Banks often post bonuses within 30–90 days after requirements are met. Put a reminder on your calendar so you can check your account balance and ensure the bonus arrives.

- Document Your Activity: Keep screenshots or PDFs of direct deposit confirmations, transaction histories, and minimum balance statements. In case of any discrepancy, you have evidence that you fulfilled the requirements.

- Maintain the Account for the Required Duration: Some bonuses stipulate you must keep the account open for six months post-bonus credit. If you close prematurely, the bank can claw back the bonus via debits or fees.

Strategies to Optimize Multiple Bonuses

If you’re comfortable managing multiple checking accounts, you can amplify your gains by “churning” sign-up bonuses responsibly. This strategy entails opening accounts sequentially, meeting bonus requirements, and then shutting down accounts once it’s safe to collect the bonus without forfeiture.

Establish a Timeline and Tracker

- Create a Spreadsheet: Include bank name, bonus amount, minimum deposit, qualification requirements, open date, deadline for meeting requirements, date bonus posts, and earliest safe account closure date.

- Prioritize Overlapping Deadlines: If two bonuses require deposit thresholds within overlapping 30-day windows, ensure you have sufficient liquidity.

- Stagger Account Openings: To avoid confusion and prevent overlap that strains your cash flow, open new accounts only after you’ve met all requirements for existing accounts.

Cover the Minimum Deposits

- Utilize Temporary “Sweeper” Accounts: If needed, apply for a temporary personal loan or HELOC draw (home equity line of credit) to fund deposits, understanding that you’ll pay interest only if you carry an outstanding balance. Sometimes the interest expense is less than the bonus’s net gain. Only use credit if you’re confident you can repay swiftly.

- Employ Liquidity Buffers: Maintain a liquid emergency fund in a high-yield savings account from which you can withdraw funds without penalty to meet multiple minimum deposit requirements.

Mind Your Credit Score

- Limit Hard Inquiries: Many banks perform a hard pull on your credit during the account application process. Too many inquiries within a short period can ding your credit score.

- Space Out Applications: Ideally, wait at least 30 days between applications to reduce the cumulative impact of multiple inquiries on your credit profile.

- Monitor Your Credit Reports: Check your credit reports monthly via free services to ensure all inquiries are correctly attributed and there are no fraudulent entries.

Avoid Bonus Clawbacks

- Keep Required Minimum Balances: If the bonus requires you to keep $5,000 for 90 days, do not withdraw that money prematurely.

- Maintain the Account for the Directed Period: If the terms state you must hold the account open for six months after receiving the bonus, mark that date and refrain from closing until the deadline passes.

- Unlink Automated Transfers Gradually: If you used an automated external bank transfer to fund the account, ensure the transaction has fully cleared before transferring money back out.

By diligently tracking each account’s requirements and timelines, you can systematically harvest multiple bonuses—potentially earning thousands of dollars annually—while maintaining a healthy credit profile.

Integrating New Checking Accounts into Your Broader Financial Plan

Opening a promotional checking account should not be an isolated tactic; it ought to fit within your overall financial strategy. Here’s how to leverage these accounts to reinforce your larger goals, whether they involve debt repayment, building an emergency fund, or optimizing your investment portfolio.

Accelerating Debt Paydown

- Redirect Bonus Funds to High-Interest Debt: Instead of treating the bonus as “fun money,” apply it toward credit card balances or high-interest personal loans. A $300 bonus directed to a credit card with a 20% interest rate can save you roughly $60 per year in interest costs.

- Combine with Balance Transfer Offers: If you also qualify for a 0% APR balance transfer credit card, use promotional periods to consolidate high-interest debt. The cash bonus from your checking account effectively reduces the principal, while the balance transfer pauses interest accrual on existing balances.

Building or Bolstering Your Emergency Fund

- Seed a High-Yield Savings Account: After you receive and clear the checking account bonus, consider transferring it to an FDIC-insured high-yield savings account or money market fund. Even at a 4.00%–5.00% APY, your bonus can earn an additional $12–$20 annually until you need it.

- Maintain Multiple “Buckets”: Use separate checking accounts to segregate your emergency fund from your spending money. For instance, retain a “rainy day” buffer in a separate branded checking account that complements your primary, promotional account.

Funding Investment Goals

- Micro-Invest with Bonus Funds: Route your banking bonuses into your brokerage account or a tax-advantaged retirement vehicle. A $500 infusion into a Roth IRA early in the year can yield substantial tax-free growth over decades.

- Automate Contributions: If you open a new checking account with direct deposit, set up automatic transfers to move a portion of each paycheck into your investment accounts—capitalizing on dollar-cost averaging.

Streamlining Bill Payments and Cash Flow Management

- Allocate an Account for Recurring Bills: Use a no-fee checking account exclusively for mortgage, utilities, and subscription payments. Linking this account to auto-pay features reduces the risk of late fees and helps with budgeting.

- Take Advantage of Cashback on Regular Expenses: If you opened a cashback checking account, route typical household or business expense transactions—like grocery orders or small service fees—through this account to accumulate rewards. Over time, this can offset other discretionary spending.

Pitfalls to Watch Out For: Avoiding Common Traps

Even the most attractive checking account offer can come with hidden drawbacks. By staying vigilant and reading the fine print, you can sidestep the following pitfalls:

Maintenance Fees That Reappear After the Bonus

Sometimes banks advertise “free checking for one year,” but after that promotional period, the account reverts to a $10–$15 monthly fee unless you meet higher thresholds than originally required. If your balance drops below the post-promotion minimum, you could start incurring fees unexpectedly.

Complicated Qualification Criteria

Offers that require multiple, nuanced steps—like a combination of direct deposit, minimum debit transactions, and eBill enrollments—can trip you up. If you miss a single requirement (such as forgetting to enroll in online banking eStatements), you might earn a much lower or nonexistent bonus.

Limits on Bonus Eligibility

Banks may exclude customers who have previously had accounts with them, even if your last account was closed years ago. Some institutions also require a minimum age—most commonly 18 for adults, though senior-specific offers might mandate a minimum age of 55 or 60.

Temporary or Introductory Rates

High APYs on checking accounts are often introductory. After 6–12 months, many banks slash the rate down to 0.01% or 0.05% APY. If you’re counting on that rate for long-term savings, verify how long the promotional rate lasts and what the ongoing rate will be afterward.

Potential Impact on Your Credit Score

While occasional inquiries have minimal effect, opening multiple accounts for bonuses in a short period can temporarily lower your credit score. High credit utilization on linked credit lines or frequent balance transfers to meet deposit requirements can also trigger negative credit implications.

Inadequate Customer Service

National mega-banks sometimes provide subpar customer support, particularly for promotional accounts that funnel customers through online-only channels. If you encounter an issue—say, the bonus never appears—resolving it via chat or email can be time-consuming and frustrating. If in-person assistance matters to you, favor regional banks or credit unions with brick-and-mortar branches.

Step-by-Step Recap: Putting It All Together

- Define Your Objectives: Are you after a one-time bonus, ongoing perks, or both? Clarify your short-term and long-term banking goals.

- Assess Your Banking Profile: Analyze your direct deposit frequency, average account balances, debit card usage, and reliance on ATM access.

- Compare Offers: Use comparison websites (e.g., Bankrate, NerdWallet, Credit Karma) and “pre-qualify” tools to find promotions that align with your profile.

- Verify Eligibility and Fine Print: Read the terms thoroughly, confirming minimum deposit sources, direct deposit definitions, and bonus crediting timelines.

- Prepare Documentation: Gather ID, proof of address, and employer/other funding source details before applying.

- Apply and Fund: Submit your online or in-branch application, then deposit the required funds promptly. Set up direct deposit if needed and begin making qualifying debit transactions.

- Track Progress: Maintain a personal bonus tracker or spreadsheet, noting deadlines, requirements, and follow-up dates.

- Monitor Bonus Posting: Check your account balance regularly. If the bonus fails to post within the promised window, contact customer service with documentation.

- Leverage Bonus Strategically: Allocate the bonus toward debt reduction, emergency savings, or investments immediately to maximize its impact.

- Plan for Next Steps: Once you’ve secured your bonus and satisfied the minimum hold period, determine whether to keep the account open for ongoing perks or close it and move on to the next promotion.

Real-World Example: A Case Study of Banking Bonus Chasing

To illustrate the potential gains, consider a hypothetical scenario involving four checking account openings in twelve months:

- January 2025: Coastal Financial Bank

- Bonus: $400 (deposit $2,000 + direct deposit)

- Action: You deposit $2,000 from your emergency fund, set up your biweekly paycheck as direct deposit, and make 12 debit transactions by the end of February. By March 15, you receive the $400 bonus. You keep the $2,000 in the account for 90 days to earn 1.00% APY (roughly $5 in interest). At the end of June, you close the account and pocket a net gain of $405 (minus a $25 transfer fee to move money back to your savings account), for a net of $380.

- April 2025: Apex National Credit Union

- Bonus: $300 (deposit $1,500 + direct deposit)

- Action: You transfer $1,500 from your primary checking to Apex, establish direct deposit, and make repeat small debit transactions. By June 15, you receive $300. You maintain a $500 daily balance to avoid the $5 fee, yielding an additional $1.25 in interest for June. At the end of September, you close the account, pocketing net $296.25.

- July 2025: Summit Digital Bank

- Bonus: $500 (deposit $5,000)

- Action: Tap into a low-interest personal loan at 3% APR to fund the $5,000 minimum deposit. You keep the balance for 90 days, earning 2.00% APY for 3 months on $5,000—approximately $25 in interest. After 90 days, you withdraw your $5,000 to pay down the personal loan and receive the $500 bonus. Net bonus after interest and loan interest (~$37.50 in 3 months) is $487.50. You immediately transfer the funds to a high-yield savings account.

- October 2025: Heritage State Bank

- Bonus: $250 (deposit $1,000 + debit transactions)

- Action: You deposit $1,000 from your primary checking, execute 10 debit card purchases, and maintain the $1,500 required balance for fee waiver. In December, you receive $250 bonus and keep the account open to continue earning 1.50% APY on $5,000 by redirecting your paycheck into this account.

Across these four promotions, your total net bonus inflows are approximately $1,463.75 in one year, combined with interest earnings and loan interest costs factored in. This strategy required managing four accounts over the year, aligning your paychecks to direct deposit requirements, and tracking each bonus schedule. With careful organization—such as maintaining a shared spreadsheet or digital calendar—this multifaceted approach can yield significant rewards with minimal extra effort.

Tactical Tips for Seamless Bonus Qualification

- Automate Where Possible: Use calendar software or task management apps to set reminders for deposit deadlines, required transaction windows, and bonus posting dates.

- Leverage Gig Income for Deposits: If you work freelance or gig jobs, route one-time project payouts directly into a new checking account to meet minimum deposit requirements. This way, you avoid tapping into your primary savings.

- Combine Small Bills to Maximize Debit Transactions: Instead of making a single large purchase, split bills into smaller transactions—when permissible—to meet the required number of debit transactions without inflating your spending.

- Use Prepaid Gift Cards for Additional Transactions: Some checking accounts count prepaid debit purchases toward the required transaction count. By buying a $50 prepaid gift card for groceries, you fulfill one transaction without overspending. Just ensure the bank doesn’t exclude such transactions from qualification.

- Schedule Transfers Strategically: If the bank allows internal transfers to satisfy minimum deposits, coordinate the timing so funds land within the qualifying window. Set up scheduled transfers from your primary bank on the day after account opening.

- Take Advantage of Overdraft Grace Periods: While you should always aim to avoid overdrafts, knowing a bank’s courtesy grace period can prevent accidental disqualifications if your balance dips briefly below the required minimum.

- Monitor Required Transactions Against Settled Transactions: Keep in mind that some banks only count settled (cleared) transactions toward the monthly debit count. If you swipe your card for $20 on the last day of the month, it might not post until the next month—potentially missing the monthly requirement.

Leveraging Additional Resources and Tools

- Comparison Websites and Cashback Forums: In addition to Bankrate (https://www.bankrate.com/banking/checking/best-checking-accounts/) and NerdWallet (https://www.nerdwallet.com/best/banking/checking-accounts), consider joining forums such as Reddit’s r/churning or Bogleheads to learn about current promotions and user experiences.

- Banking Apps for Account Aggregation: Use financial aggregator apps like Mint or Personal Capital to track multiple accounts in one dashboard, receive alerts when promotional interest rates change, and monitor bonus-qualification progress in real time.

- Credit Monitoring Services: Because opening multiple new accounts can influence your credit, sign up for a free credit monitoring service like Credit Karma or a bank’s complimentary monitoring service to watch for unexpected inquiries or report errors promptly.

- Automated Bill Pay: Consolidate recurring bills into a single checking account and automate payments to ensure you meet the minimum monthly debit transaction requirements without thinking about it.

Frequently Asked Questions About Checking Account Bonuses

Q: Will multiple accounts from the same bank qualify for separate bonuses?

A: Generally, banks only allow one bonus per household or Social Security number. Attempting to open multiple accounts for repeat bonuses violates most bank terms and can lead to account closure without bonus credit. However, some banks make exceptions if you have a unique account type (e.g., one personal checking and one business checking) with proof of separate ownership. Always verify with the bank’s fine print or customer service before attempting to claim multiple bonuses.

Q: Do joint accounts count as separate accounts for bonus qualification?

A: No. If you open a joint account with someone else, both parties share the Social Security number (SSN) requirement. Banks typically limit bonuses to one per SSN. Instead, you and your spouse or partner may consider opening individual accounts in your respective names to each claim a bonus, provided you meet the eligibility criteria separately.

Q: If I close my account after receiving the bonus, will my credit score suffer?

A: Closing a checking account does not directly affect your credit score, because most banks do not report checking account closures to credit bureaus. However, multiple hard inquiries from opening new accounts can temporarily lower your score. Additionally, if you had an overdraft line of credit attached to the checking account, closing it could impact your overall credit utilization ratio. Monitor your credit and space out new account openings accordingly.

Q: Are there tax implications for receiving checking account bonuses?

A: Yes. Checking account bonuses are considered miscellaneous income and are typically reported on IRS Form 1099-INT or 1099-MISC if the bonus exceeds $10 for the year. The bank will issue the tax form by February of the following year. Plan accordingly if you anticipate your tax bracket might be affected. In most cases, the tax owed on a $300–$500 bonus is minimal, but it’s wise to set aside a portion in anticipation.

Q: What happens if my direct deposit is delayed and doesn’t post within the required window?

A: If you miss the deadline for direct deposit due to your employer’s payroll cycle or a setup error, contact the bank’s customer service immediately. Some banks offer grace periods or allow manual verification of direct deposit. However, many banks rigidly adhere to the stated timelines. If your direct deposit arrives even one day late, you forfeit the bonus. To mitigate this, set up direct deposit well in advance—preferably before opening the account—and verify that the bank acknowledges it in writing or via email.

Q: Can I meet the direct deposit requirement through mobile check deposits?

A: It depends on the bank. Some banks explicitly specify that direct deposit must originate from an employer, government benefit, or non-affiliated third party deposit. Others accept mobile check deposits from payroll checks. Always confirm with the bank regarding acceptable forms of “qualifying direct deposit.” If you’re uncertain, call or chat with customer support before making any assumptions.

The Road Ahead: Continuously Refreshing Your Checking Strategy

The banking industry is perpetually competitive; new promotions emerge almost weekly, and existing offers can evaporate without warning. To ensure you’re never leaving money on the table:

- Set Quarterly Reviews: Every three months, revisit top banking websites and personal finance blogs to identify newly launched checking account bonuses. Your circumstances may have changed—address modifications, new employment, or fluctuating balances—so a fresh assessment can uncover new opportunities.

- Maintain an Automated Tracking System: Leverage personal finance software or simple spreadsheets with built-in formulas that calculate your net gain after fees, interest, and taxes. This helps you prioritize offers with the highest net return.

- Reinvest Your Gains: Each $250–$500 bonus you earn can serve as the cornerstone of your next financial priority—be it a down payment fund, retirement contribution, or investment in index funds. By cycling through checking account bonuses responsibly, you effectively bootstrap other aspects of your financial life.

- Expand to Business Checking If Applicable: If you’re a small business owner or side-hustler, explore business checking promotions. Banks often offer separate bonuses for business accounts that can dwarf consumer checking offers, provided you meet merchant or payment volume minimums.

- Stay Educated on Regulatory Changes: Federal Reserve regulations, such as Regulation D (which caps certain types of transfers from savings accounts) and changes to overdraft rules, can influence account features and fees. Remain vigilant about shifts in consumer banking regulations that might affect your strategy.

Seize Control of Your Checking Account Destiny

In an era of historically low interest rates and minimal banking fees, checking account promotions represent a rare, low-risk way to earn a tangible return on money you already plan to park for day-to-day expenses. Whether you’re new to personal finance or a seasoned professional seeking incremental gains, systematically exploring—and capitalizing on—checking account bonuses can yield hundreds or thousands of dollars annually, all with little more effort than opening an account, meeting basic requirements, and scheduling timely reminders.

By comprehending how banks structure these offers, aligning them with your financial habits, and executing a well-organized approach, you transform a seemingly mundane task—managing a checking account—into a dynamic wealth-building strategy. Remember, bonuses are only one piece of the puzzle. Consider long-term benefits, customer service quality, and the broader relationship potential when choosing where to bank. Just as you wouldn’t settle for mediocre credit card rewards or a subpar savings account, don’t accept a suboptimal checking account.

Begin your next quest for the perfect checking account offer today: compare, apply, and watch your balance grow in ways you never thought possible. By treating checking accounts as strategic assets rather than mere transactional hubs, you’ll truly maximize your benefits and ensure you’re never leaving money on the table.

Source: Bankrate. “Best Checking Accounts of 2025.” Bankrate.com. https://www.bankrate.com/banking/checking/best-checking-accounts/