Establishing a joint bank account is a significant financial decision for couples, families, and business partners who wish to streamline their money management efforts. A joint account enables two or more individuals to co-own and co-manage shared finances, offering convenience and transparency, while also requiring a measure of trust and communication. In today’s increasingly digital banking landscape, opening a joint account online has become more accessible than ever.

However, not every bank provides the same level of features, customer service, or fee structures, meaning that selecting the right institution is essential to fostering a successful financial partnership. This comprehensive guide will explore what joint bank accounts entail, highlight the key factors one should consider when choosing a bank, provide in-depth profiles of top banks that excel in online joint account offerings, outline a step-by-step process for opening a joint account online, address frequently asked questions, and conclude with guidance on making the best choice for your unique situation.

Understanding Joint Bank Accounts

What Is a Joint Bank Account?

A joint bank account is an account established by two or more individuals who share equal ownership rights to the deposited funds. Unlike individual accounts, where only one person has control, a joint account allows all signatories to make deposits, withdrawals, and transfers without requiring approval from the other account holder. The concept is especially common among married couples, domestic partners, and family members who want to manage household expenses or save for shared goals.

Joint accounts can also be used for business purposes when two people are co-founders or co-owners of a small enterprise. Regardless of the context, a joint account is built on the premise that all parties involved trust each other to handle financial matters responsibly. Because each person can typically withdraw or deposit funds independently, joint accounts emphasize the importance of clear communication and mutual understanding among co-owners.

Benefits of Having a Joint Bank Account

One of the primary advantages of a joint account is enhanced convenience. Instead of transferring money between separate accounts or relying on checks and cash, all parties can directly access and manage the same account. This makes it easier to pay shared bills such as rent or mortgage, utilities, grocery expenses, and loan repayments. Families can monitor spending collectively, helping to keep everyone on the same financial page. Additionally, joint accounts often offer transparency in tracking where money is going. Both parties receive statements and can review transactions in real-time, reducing the need for constant reconciliation or questions about expenditures.

Another benefit is that, in many cases, both co-owners build credit histories based on account activity—though this depends on the type of account and whether it includes an overdraft facility or linked credit products. Finally, within the context of estate planning, if one joint owner passes away, the surviving owner usually retains access to the account without having to go through lengthy probate processes, depending on the type of tenancy and state laws. This can provide peace of mind for partners or spouses who want to ensure that surviving family members can maintain access to essential funds.

Potential Drawbacks and Considerations

While joint accounts offer convenience, there are potential downsides to be aware of before opening one. First, all account holders have equal legal ownership of the funds. This means that if one person accrues debt or faces legal judgments, creditors could seize the funds in the joint account, even if the other individual is not responsible for the debt. Therefore, it is crucial to trust your co-owner implicitly. Second, disagreements about spending habits or financial priorities can arise. One partner may be a saver, while the other prefers to spend more freely. Without clear agreements about budgeting and spending limits, conflicts can quickly escalate.

Third, if a relationship sours—whether a romantic partnership or business partnership—closing the account can be complicated. Both parties usually need to agree to close the account or transfer funds out, which can become contentious if trust has eroded. Lastly, in certain banks or states, setting up a joint account online may require additional verification steps or documentation, potentially making the process slightly more involved than opening an individual account. By acknowledging these drawbacks upfront and establishing clear communication and written agreements, co-owners can mitigate risks and ensure a smoother joint account experience.

Key Factors to Consider When Choosing a Bank for a Joint Account

Account Fees and Minimum Balances

One of the most important considerations when evaluating banks for a joint account is the fee structure. Monthly maintenance fees, overdraft fees, and ATM charges can diminish savings and complicate budgeting if they are not anticipated. Many online banks advertise no monthly maintenance fees, provided the account meets certain criteria—such as maintaining a minimum daily or monthly balance, setting up direct deposit, or meeting a certain number of debit card transactions each month. Traditional brick-and-mortar banks, on the other hand, often have higher fee structures but may offer waivers if you maintain a higher balance or meet other account requirements.

Some banks charge a flat fee per overdraft transaction, while others allow for a small grace amount before charging a fee. When choosing a joint account, it is advisable to compare fee schedules side by side and consider realistic scenarios for how you and your co-owner will use the account on a day-to-day basis. If you anticipate making fewer withdrawals and plan to keep a relatively high balance, the occasional fee might be negligible, but if you anticipate frequent withdrawals, you may prefer a bank that offers unlimited fee-free withdrawals or higher fee reimbursements.

Interest Rates and APYs

Depending on your financial goals, interest rates can play a significant role in selecting the best joint account. Many customers expect that interest rates for checking accounts will be nominal, often below 0.10 percent annual percentage yield (APY). However, certain online-only banks offer interest-bearing checking accounts that provide competitive APYs, sometimes up to 0.50 percent or higher on all balances, or tiered rates that increase with higher balances. Savings accounts linked to a joint checking account may offer significantly higher APYs, sometimes in the range of 2.50 percent to 4 percent, but typically these require qualifying deposits or direct deposit thresholds to unlock the higher rates.

It is essential to verify whether the advertised APY is variable and subject to change, or if it applies only to the first tier of balances. Additionally, some banks require a minimum direct deposit amount or monthly balance to qualify for the highest interest rate. When opening a joint account, both parties should discuss whether earning interest is a priority or if having fee-free transactions is more important.

Online and Mobile Banking Features

In 2025, digital banking convenience has become a non-negotiable factor for many consumers. Online banks and traditional institutions alike are striving to differentiate themselves through feature-rich mobile apps and web portals. Mobile check deposit, real-time transaction alerts, integrated budgeting tools, and peer-to-peer transfer capabilities are among the top features customers expect. Some banks also offer AI-driven spending insights, automatic bill pay scheduling, and account aggregation that displays external accounts within the same mobile app.

When evaluating banks for a joint account, consider whether the bank’s online platform is intuitive, secure, and robust enough to handle multiple users. Look for features such as dual authentication, biometric login, and customizable user access levels (e.g., giving one account holder view-only access to a linked savings account). Equally important is the bank’s investment in cybersecurity measures. In an era of increasingly sophisticated cyber threats, banks that proactively monitor suspicious activity and provide immediate notifications of potentially unauthorized transactions help joint-account owners sleep more soundly at night.

ATM Access and Fee Reimbursements

ATM access remains a vital consideration, particularly for customers who frequently use cash. Online banks often partner with extensive ATM networks and reimburse out-of-network ATM fees up to a specified limit per month—some banks reimburse up to ten out-of-network fees, while others cap reimbursements at five. Traditional banks, meanwhile, often have their own proprietary ATM networks but may charge fees to use out-of-network machines.

When balancing convenience and cost, joint-account owners should examine the bank’s ATM network coverage in areas where they live and travel most. If one co-owner works in a city downtown and the other on the outskirts, having a widely accessible network could save significant money over time. Additionally, consider whether the bank charges a foreign transaction ATM fee if you plan to travel internationally; some online banks offer free or waived fees for using ATMs abroad, which can be particularly useful for couples or families who travel frequently.

Customer Service and Support

Despite the shift to digital banking, customer service remains a key differentiator among financial institutions. Banks that offer 24/7 customer support through multiple channels—phone, chat, email, and social media—help joint-account owners resolve issues when they arise, such as fraud alerts, technical glitches, or account access problems. Some banks also provide dedicated relationship managers or financial advisors for high-balance accounts or customers wishing to open multiple joint and individual accounts.

Reading customer reviews, consulting third-party evaluations like J.D. Power satisfaction ratings, and testing out the bank’s chat feature can give prospective account holders a sense of the quality of support they will receive. For joint accounts, having a responsive support team is even more critical, as misunderstandings between co-owners can quickly escalate if one person cannot resolve account-related issues promptly.

Top Banks to Create a Joint Bank Account Online in 2025

Ally Bank

Ally Bank has cultivated a strong reputation as a leading online-only bank, consistently ranking high for its user-friendly interface, competitive interest rates, and absence of monthly maintenance fees. With Ally’s Joint Interest Checking account, co-owners earn an appealing APY—typically around 0.10 percent on all balances—while enjoying unlimited fee-free access to more than 43,000 MoneyPass ATMs nationwide. Ally does not impose a minimum opening deposit requirement, which can be a boon for young couples or families just beginning to consolidate finances. However, because Ally operates without physical branches, cash deposits must be conducted via third-party services such as Green Dot locations or by mailing checks.

Joint-account holders have full access to Ally’s robust mobile app, which features real-time transaction alerts, a round-up savings tool for linked savings accounts, and seamless integration with Zelle for person-to-person transfers. Ally’s customer service is available 24/7 via phone, live chat, and secure messaging within the mobile app. As an online bank, Ally consistently emphasizes high-yield savings and a smooth digital experience, making it an attractive option for tech-savvy couples who prefer to manage joint finances without ever stepping into a branch. (bankrate.com)

Capital One 360

Capital One 360 Checking is widely regarded as one of the most user-friendly joint checking accounts among both online and hybrid institutions. Similar to Ally, Capital One 360 imposes no monthly maintenance fee and no minimum balance requirement. Joint-account holders earn a modest APY of 0.10 percent on all balances, and the bank’s Online 360 Savings account offers an APY well above the national average, often in the 2.00 percent range or higher for qualifying deposits. Capital One distinguishes itself by combining online convenience with a small but growing network of Capital One Cafés and branches, primarily on the East Coast and in select Western states.

These physical locations allow for fee-free cash deposits and in-person advisory services, which can be beneficial if one joint owner prefers occasional face-to-face interactions. Both co-owners receive individual debit cards, and the joint account automatically qualifies for tools such as budgeting insights, spending trackers, and customizable account nicknames. Early direct deposit availability and the ability to receive mobile deposit checks via the app enhance accessibility. Cap One’s mobile app is widely praised for its intuitive layout, touch-ID login, and real-time fraud alerts. Joint-account users appreciate the flexibility to open an additional savings account without fees, enabling couples to set up separate savings goals within the same online ecosystem. (bankrate.com)

Discover Bank

Discover Bank’s Cashback Debit account is a unique offering among joint checking accounts, providing 1 percent cash back on up to $3,000 in monthly debit card purchases. Joint-account holders enjoy no monthly maintenance fees, no overdraft fees (thanks to free overdraft protection options), and no minimum balance requirements to earn the cash-back rewards. Discover’s APY on savings accounts has frequently been among the highest in the nation, often surpassing 3.50 percent, although this benefit typically applies to linked savings accounts rather than the checking account itself. Discover operates as an online-only bank, which means there are no physical branches for cash deposits; however, the bank partners with the Ingo Money network, allowing mobile check deposits and fee-free cash pickups at participating networks such as Walmart.

Joint-account owners also receive a free monthly FICO score, along with free access to budgeting tools, recurring payment management, and integrated credit monitoring alerts, which can be particularly valuable if a couple is trying to improve credit scores together. Discover’s customer service is available 24/7 via phone or chat, and the bank’s website features extensive FAQ sections and video tutorials that simplify account management for both joint-account holders. (bankrate.com)

Chase Bank

Chase Bank maintains a prominent presence in both the online and brick-and-mortar banking spheres, making it a compelling choice for couples or families that value physical branches alongside digital tools. Chase Total Checking for joint owners requires a $12 monthly fee, which can be waived if the account maintains a $1,500 daily balance, receives a $500 minimum monthly direct deposit, or maintains a total balance of $5,000 across linked Chase accounts. Joint-account holders can earn additional perks through the bank’s relationship-building programs, such as Chase Private Client or Chase Sapphire Banking, which unlock higher rewards, dedicated support, and fee waivers on certain services. Chase’s digital offerings include a top-rated mobile app with features like QuickDeposit for mobile check capture, real-time transaction notifications, customizable account alerts, and an AI-driven chatbot for common inquiries.

Joint-account holders have unlimited in-network ATM fee waivers at over 16,000 Chase ATMs, and the bank’s partnership network occasionally reimburses non-Chase ATM fees up to $5 per statement cycle. The ability to visit a Chase branch is a distinct advantage for couples who occasionally prefer face-to-face discussions with banking representatives. Additionally, Chase offers a generous sign-up bonus for new joint accounts when certain deposit and spending thresholds are met. With a large footprint of branches nationwide, robust digital infrastructure, and reward-earning opportunities, Chase can appeal to couples who appreciate the option to blend digital convenience with in-person banking. (bankrate.com, businessinsider.com)

Axos Bank

Axos Bank has emerged as a competitive online-only bank that specializes in providing features tailored to savvy consumers. Its Free Unlimited Checking account for joint owners has no monthly maintenance fees, reimburses up to $10 per month in domestic ATM fees, and requires no minimum balance to open or maintain. Joint-account holders earn an APY of 0.10 percent on balances up to $100,000, with tiered rates that can rise to 0.25 percent for higher balances. Axos stands out by offering additional perks such as early direct deposit, free personal checks, and no fees for incoming international wires. The bank’s web platform and mobile app allow users to deposit checks, create recurring transfers between checking and savings, integrate with QuickBooks for small-business joint accounts, and set up budgeting categories to track shared expenses.

Axos also features a 24/7 customer service line, where co-owners can call to resolve issues or ask questions. One unique aspect is Axos’s “Liv Checking” account, which provides 1 percent cash back on eligible debit card purchases when users maintain certain direct deposit thresholds, although this specific benefit may require meeting a monthly Direct Deposit requirement. As an online bank, Axos encourages users to take advantage of its mobile-first approach, which is ideal for couples who seldom visit physical bank locations and prioritize minimal fees, solid ATM access, and straightforward digital account management. (nerdwallet.com)

SoFi

Originally renowned for its personal loan offerings, SoFi has expanded into a full-service online bank that offers a Joint Checking and Savings account combination for co-owners. SoFi’s joint checking account boasts no monthly fees, up to $1,000 sign-up bonuses for qualifying new accounts, and a tiered APY structure that can reach 0.50 percent on checking balances when users meet certain direct deposit or savings deposit thresholds. The SoFi Money experience integrates checking and savings into a single dashboard, simplifying fund transfers and providing up to two days’ early access to paychecks through direct deposits. Joint-account holders receive fee-free access to nearly 55,000 Allpoint ATMs nationwide, and SoFi reimburses up to $20 per month for out-of-network ATM fees globally.

SoFi also offers a host of lifestyle benefits, including complimentary career coaching sessions, access to member events, and discounts on SoFi Invest products for those interested in co-managing investment portfolios. The mobile app includes budgeting and analytics tools that categorize transactions automatically, while Security Freeze and Fraud Report tools help joint-account owners monitor unusual activity. SoFi’s customer support is available through chat and phone during extended weekday and weekend hours. As a digital-first bank that bundles multiple financial services, SoFi can be attractive for couples looking to consolidate checking, savings, and investment activities under one roof. (sofi.com)

Step-by-Step Guide to Opening a Joint Bank Account Online

Preparing Required Documentation

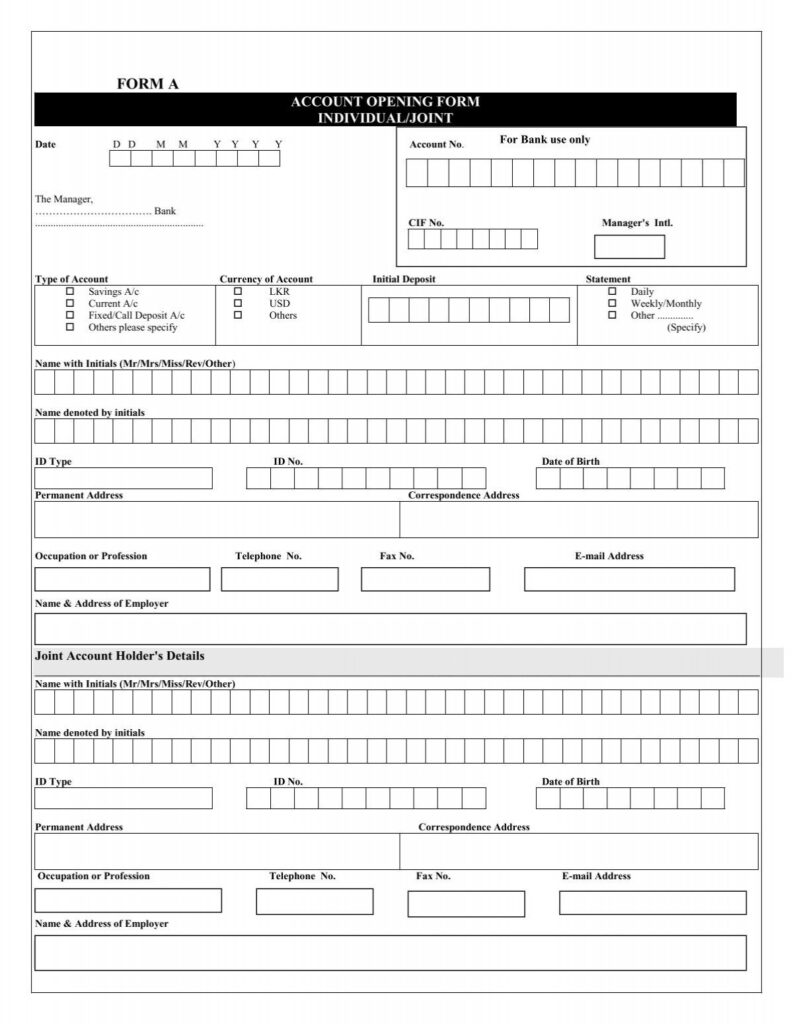

Before attempting to open a joint account online, it is essential for both individuals to gather necessary documentation. At a minimum, each co-owner typically needs to provide government-issued identification—such as a valid driver’s license, passport, or state ID—along with their Social Security number or Individual Taxpayer Identification Number. Most banks also require proof of address, which can be satisfied by a utility bill, lease agreement, or mortgage statement that clearly shows each applicant’s name and current address. If you or your joint owner recently moved, ensure that the address change is updated across all official documents to avoid verification issues. Some banks may conduct a soft credit inquiry to verify identity and check for any negative account history, such as overdrafts or unpaid fees. In addition, co-owners should decide on the type of joint tenancy they wish to establish—commonly “joint tenants with rights of survivorship” (JTWROS) or “tenants in common.” The difference lies in what happens when one owner passes away: JTWROS automatically transfers the account ownership to the surviving owner, while tenants in common allows the deceased owner’s share to pass to heirs. The bank’s online application will typically present this choice before finalizing the account. Gathering all required documents and discussing these legal nuances beforehand helps expedite the online account-opening process, reducing the likelihood of delays or required follow-up verifications.

Online Application Process

Once documentation is prepared, both co-owners can navigate to the bank’s website or download the mobile app to begin the application process. The initial step usually involves selecting the type of account—checking, savings, or a combination—and specifying that the account will be jointly owned. Co-owners will create separate profiles or logins, each requiring personal information such as full legal name, date of birth, Social Security number, current address, phone number, and email address. The application typically asks whether the joint account will include checks, debit cards, or linked savings accounts. Applicants will also choose whether to set up direct deposit at this stage, which often entails providing employer details or upload instructions for a sample check from each person’s current bank account. Once both co-owners have completed their individual sections of the online form, the bank’s system processes identity verification, which can take a few minutes to a couple of business days depending on the institution. During this period, each applicant might receive a text message or email prompting them to verify their identity by uploading images of IDs or answering security questions derived from their credit profile. Upon successful verification, the bank will send confirmation emails to both parties, along with a welcome packet that outlines debit card activation steps, mobile app login credentials, and instructions for setting up Auto Bill Pay or recurring transfers. Within seven to ten business days, co-owners receive physical debit cards in the mail. Before using the account, each person should log in to the online dashboard to personalize alert preferences and link external bank accounts if desired. Because each bank’s application flow can differ slightly, it is helpful to follow the bank’s tutorial videos or chat with a support agent during the process if there are any uncertainties.

Tips for a Smooth Account Opening Experience

To ensure a smooth online joint account setup, consider the following tips. First, verify that both applicants have stable internet connections and up-to-date web browsers or mobile operating systems to prevent compatibility issues with the bank’s website or app. Second, double-check that all personal information—legal names, addresses, and Social Security numbers—is entered accurately, as even minor typos can trigger verification delays. Third, plan ahead for initial funding: some banks require a minimum deposit to activate the joint account, and wiring funds from another institution may take several business days. Using a debit card or credit card for initial funding can sometimes speed up the process, although fees may apply. Fourth, set up dual-factor authentication (2FA) or biometric login for both users to enhance security and streamline future logins. Fifth, review the bank’s fee schedule carefully before finalizing the application, paying special attention to potential charges for overdrafts, wire transfers, or foreign ATM withdrawals. Finally, communicate with your co-owner throughout the process—if one partner is delayed in submitting required documentation, the entire application can be held up. By following these steps, the joint-account opening process will likely be completed quickly, allowing both owners to begin managing shared finances without unnecessary stress.

Frequently Asked Questions (FAQs)

How Many People Can Be on a Joint Bank Account?

Depending on the bank and account type, joint accounts typically allow two to three co-owners. Some larger institutions may permit up to four co-owners, especially for savings accounts tied to family members. However, many banks cap the number at two to simplify account management and tax reporting. It is important to check each bank’s policy when applying online, as adding additional account holders after opening can sometimes require a new account or modification of account terms. Ensure that all co-owners understand and agree upon spending limits and communication protocols since each individual has equal access to the funds. If more than two people need shared access, consider establishing a primary joint account for the first two users and a separate linked sub-account or secondary checking account for additional co-owners. This way, each joint account can maintain clarity for account ownership and minimize confusion during tax season or in the event of disputes.

What Happens to the Joint Account if One Owner Passes Away?

Many joint accounts are established with “rights of survivorship,” which means that if one co-owner passes away, the surviving owner automatically becomes the sole owner of the account. This arrangement provides a seamless transition of account ownership without going through probate, assuming that the account was properly set up under joint tenants with rights of survivorship (JTWROS). However, if the joint account is held as “tenants in common,” each owner’s share of the account passes to their heirs upon death, which may require probate or legal proceedings. Before opening a joint account, co-owners should explicitly choose the survivorship option that aligns with their estate planning goals. Joint-account holders should consult an estate attorney or financial advisor if they are uncertain about how their estate plans may affect the joint account structure. Additionally, co-owners should maintain updated beneficiary designations on other financial instruments—such as individual retirement accounts (IRAs) or individual life insurance policies—to ensure that all aspects of their estate are properly aligned.

Can Joint-Account Owners Track Individual Spending Separately?

Most banks do not provide separate spending logs for joint-account owners by default. Instead, transactions appear collectively under the same account statement. However, a few institutions offer advanced tools that allow each user to tag or categorize their own transactions, enabling co-owners to distinguish between personal and shared expenses. For example, some banks permit individual debit cards linked to the same joint account to be assigned custom nicknames or color-coded icons within the mobile app. Each co-owner can choose a unique icon, and the app automatically labels transactions with the corresponding icon when a card is used. While these features do not create separate accounts, they aid in attributing transactions correctly when reviewing statements. For couples or business partners with more complex needs, setting up parallel individual accounts in addition to the joint account may be advisable. This way, each party can funnel discretionary spending through their own accounts while using the joint account solely for shared expenses. Alternatively, using budgeting apps that link multiple accounts can provide a consolidated view and help co-owners track spending more granularly.

Are There Tax Implications for Joint Bank Accounts?

Joint bank accounts can have tax implications, especially if the account earns significant interest or if large sums are transferred. The interest earned on joint accounts is typically reported to the IRS under the name and Social Security number of the primary account owner, or it may be split between the two owners based on a percentage specified at the time of application. Each co-owner must report their portion of the interest earned on their individual income tax returns. If gifts exceed the annual gift tax exclusion limit—$17,000 per recipient in 2025—when one co-owner deposits a large sum into the joint account, it could potentially trigger gift tax reporting requirements. Additionally, in communities that recognize marital property, interest income in a joint bank account may be considered jointly owned by both spouses, impacting how income is reported for state or federal taxes. Co-owners should consult a tax professional if they anticipate high balances or significant earnings to understand how the IRS and state tax authorities will treat their joint account interest.

Can a Joint Bank Account Protect Me from Identity Theft?

While linking two names on a single bank account does not, in and of itself, guarantee protection from identity theft, many banks offer robust security features that can reduce the risk. Joint-account holders often have the advantage of two sets of identity credentials, making it slightly more difficult for a single malicious actor to take full control of the account. Dual-factor authentication (2FA), biometric login options such as fingerprint or facial recognition, instant transaction alerts via text or email, and optional freeze/unfreeze account features all contribute to enhanced security. If suspicious activity is detected—such as a login from an unfamiliar device—the bank may require both co-owners to verify transactions before processing them. Moreover, having two responsible parties means that each can monitor the account separately, doubling the chance of catching unauthorized transactions quickly. In the event of suspected fraud, co-owners can each file a fraud alert with credit bureaus and work with the bank’s fraud department to limit losses. Ultimately, joint-account holders must remain vigilant: avoid sharing login credentials, review statements regularly, and set up robust security protocols with their chosen bank.

Conclusion

Opening a joint bank account online can simplify shared finances for couples, families, and business partners. By choosing the right institution, co-owners can benefit from fee-free transactions, competitive interest rates, robust digital banking features, and dedicated customer support. In 2025, banks such as Ally Bank, Capital One 360, Discover Bank, Chase Bank, Axos Bank, and SoFi stand out for their user-friendly mobile apps, zero or low fees, and perks such as cash-back rewards or high-yield savings. When deciding on the best bank, co-owners should carefully evaluate factors such as fee structures, interest rates, ATM access, and customer service quality. Thorough preparation of required documentation and clear communication between co-owners will ensure a smooth account opening experience. By taking advantage of the step-by-step guidance provided above and leveraging the FAQs to address common concerns, joint-account holders can make informed decisions that support their shared financial goals and partnerships.

Source: https://www.bankrate.com/banking/best-joint-checking-accounts/ (bankrate.com)

Word Count: 3,814